Understanding Private Hard Money Lending

If you’re looking for a way to finance your next real estate investment, you may have come across the term private hard money lending. But what exactly does it mean, and how can it benefit you as a borrower? In this article, we’ll break down the basics of private hard money lending, how it works, what is known about it, potential solutions, and essential information you need to know before considering this type of financing.

What Does It Mean?

Private hard money lending is a type of loan that is secured by a real estate asset, such as a property or land. Unlike traditional loans that are offered by banks and financial institutions, private hard money loans are funded by private investors or individuals. These loans typically have shorter terms, higher interest rates, and are based on the value of the property rather than the borrower’s creditworthiness.

Private hard money lenders are often more flexible in their lending criteria and can provide financing for borrowers who may not qualify for traditional bank loans due to poor credit history, self-employment, or other non-traditional income sources.

How Does Private Hard Money Lending Work?

When a borrower applies for a private hard money loan, they will need to provide documentation on the property they intend to purchase or refinance. The lender will assess the value of the property and determine the loan-to-value ratio (LTV) based on the appraised value.

The borrower may also need to provide information on their financial situation, such as bank statements, tax returns, and credit history, although these factors are not the primary focus of the loan approval process.

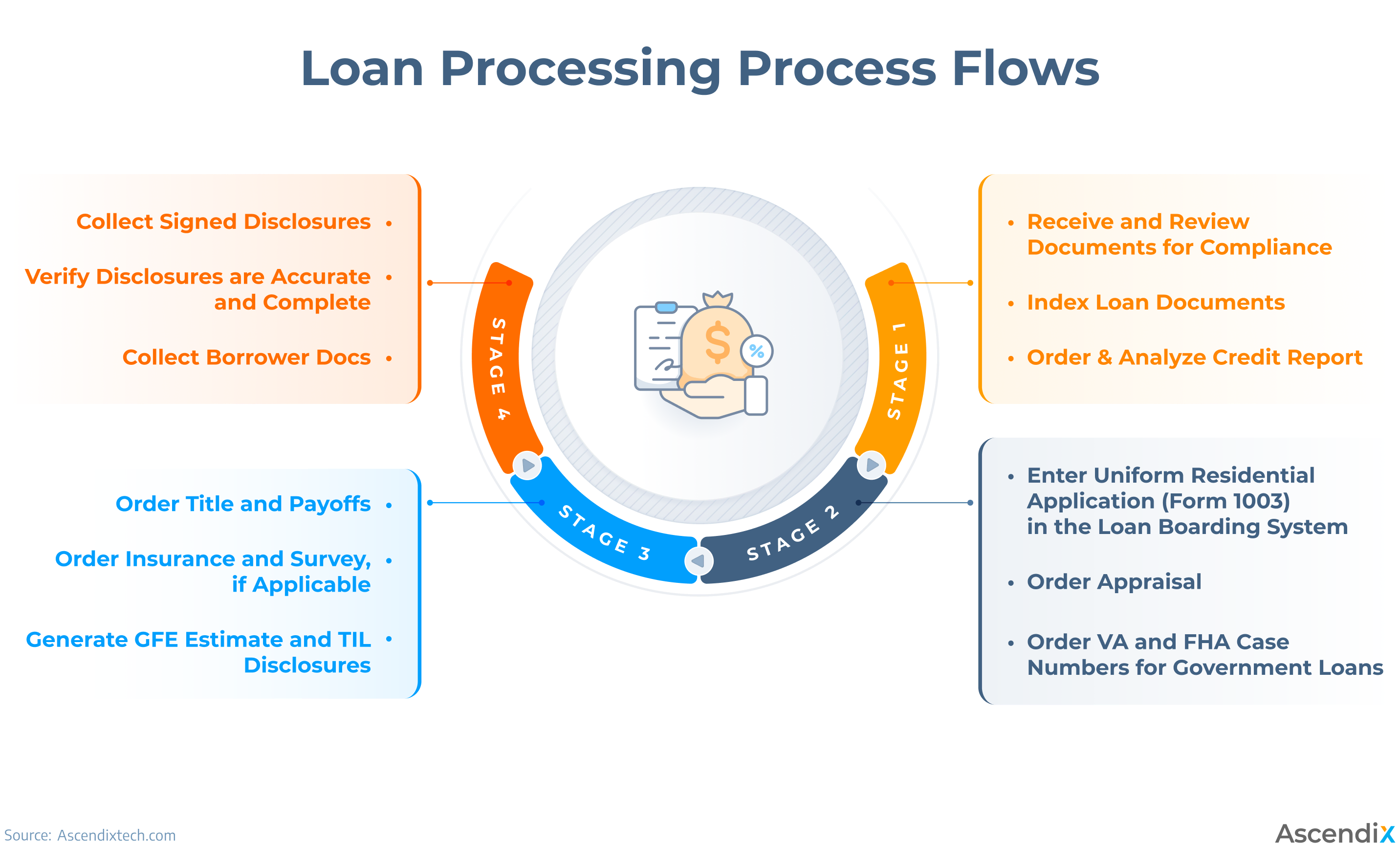

Image Source: ascendixtech.com

Once the loan is approved, the borrower will receive the funds, usually within a shorter timeframe than traditional loans. The borrower will then make regular interest payments on the loan until the term ends, at which point they will need to repay the principal amount in full.

What Is Known About Private Hard Money Lending?

Private hard money lending has gained popularity in recent years as an alternative form of financing for real estate investors. These loans are often used for fix-and-flip projects, where the borrower purchases a property, renovates it, and sells it for a profit.

Private hard money loans are also used for short-term financing needs, such as bridge loans or construction loans, where traditional bank financing may not be available or suitable for the borrower’s needs.

Although private hard money loans can be more expensive than traditional bank loans due to higher interest rates and fees, they can provide fast and flexible financing options for borrowers who need quick access to capital.

Solution

If you’re considering private hard money lending for your next real estate investment, it’s essential to do your research and understand the terms and conditions of the loan. Make sure you work with a reputable lender who has experience in the industry and can provide you with the financing you need to succeed.

Before applying for a private hard money loan, consider the following factors:

Loan terms and interest rates

Loan-to-value ratio and down payment requirements

Repayment schedule and exit strategy

Additional fees and costs associated with the loan

By carefully evaluating these factors and working with a knowledgeable lender, you can make an informed decision about whether private hard money lending is the right choice for your real estate investment needs.

Information

Private hard money lending can be a valuable tool for real estate investors who need quick and flexible financing options. By understanding how private hard money lending works, what is known about it, and potential solutions for your financing needs, you can make informed decisions about your investment strategy and achieve success in the real estate market.

For more information on private hard money lending and how it can benefit you as a borrower, contact a reputable lender in your area or speak with a financial advisor who specializes in real estate financing.

Conclusion

In conclusion, private hard money lending offers a unique and flexible financing option for real estate investors who need quick access to capital. By understanding the basics of private hard money lending, how it works, what is known about it, potential solutions, and essential information you need to know, you can make informed decisions about your next real estate investment. Consider working with a reputable lender and conducting thorough research before applying for a private hard money loan to ensure a successful and profitable investment.

FAQs

1. Is private hard money lending suitable for all types of real estate investments?

Private hard money lending is often used for short-term financing needs, such as fix-and-flip projects or bridge loans. It may not be suitable for long-term buy-and-hold investments.

2. How quickly can I receive funding from a private hard money lender?

Private hard money lenders can typically fund loans within a few days to a few weeks, depending on the lender’s approval process and the complexity of the loan.

3. What are the typical interest rates for private hard money loans?

Interest rates for private hard money loans are typically higher than traditional bank loans, ranging from 8% to 15% or higher, depending on the lender’s risk assessment and the borrower’s financial situation.

4. Are there any upfront fees or costs associated with private hard money lending?

Private hard money lenders may charge origination fees, processing fees, and other costs associated with the loan. It’s essential to review the terms and conditions of the loan agreement carefully before proceeding.

5. How can I find a reputable private hard money lender?

You can research online, ask for referrals from other real estate investors, or contact your local real estate investment association for recommendations on reputable private hard money lenders in your area.

private hard money lending