Best Home Improvement Loans

What Does It Mean?

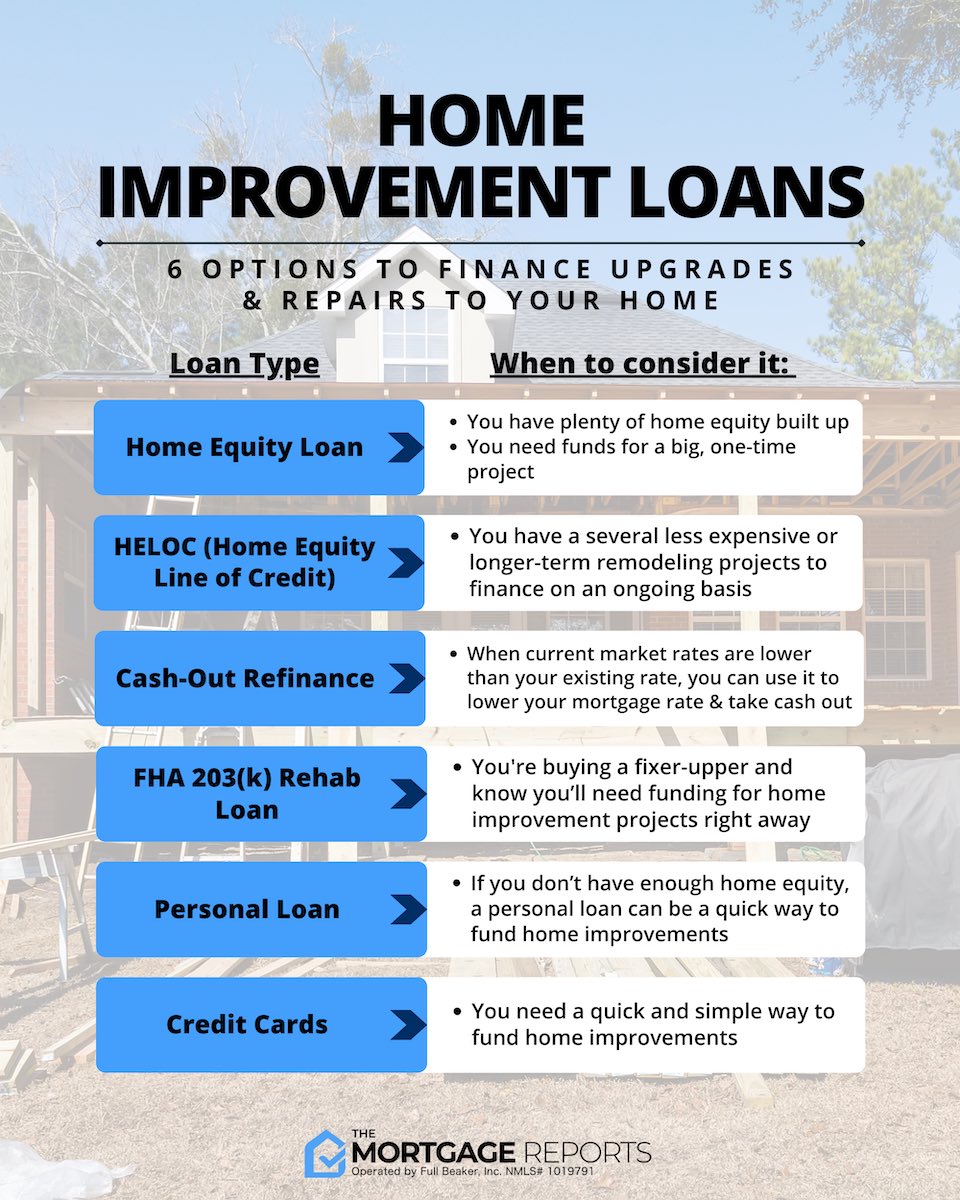

When it comes to making improvements to your home, whether it be renovating your kitchen, adding a new bathroom, or finishing your basement, the costs can add up quickly. That’s where home improvement loans come in. These loans are specifically designed to help homeowners finance their projects without having to dip into their savings or use high-interest credit cards.

How?

Home improvement loans can come in various forms, including personal loans, home equity loans, home equity lines of credit (HELOCs), and cash-out refinancing. Each type of loan has its own set of requirements, terms, and interest rates, so it’s important to do your research and find the best option for your specific needs.

What Is Known

Image Source: themortgagereports.com

One of the main benefits of home improvement loans is that they can help increase the value of your home. By making upgrades and renovations, you can potentially boost your home’s resale value, which can be beneficial if you plan to sell in the future. Additionally, home improvement loans typically have lower interest rates than credit cards, making them a more affordable option for financing your projects.

Solution

When looking for the best home improvement loan, it’s important to shop around and compare rates from different lenders. You’ll want to consider factors such as the loan amount, interest rate, repayment term, and any fees associated with the loan. It’s also a good idea to check your credit score before applying, as this can impact the interest rate you receive.

Information

Some lenders may require you to have a certain amount of equity in your home to qualify for a home equity loan or HELOC. If you don’t have enough equity, a personal loan may be a better option. Additionally, some lenders offer specialized home improvement loans that are specifically tailored for renovation projects, so be sure to inquire about any specific loan products that may be available.

Conclusion

Overall, home improvement loans can be a great way to finance your projects and increase the value of your home. By doing your research, comparing rates, and finding the best loan option for your needs, you can make your home improvement dreams a reality without breaking the bank.

FAQs

1. How do I qualify for a home improvement loan?

2. What are the benefits of using a home equity loan for renovations?

3. Can I use a personal loan for home improvements?

4. What is the difference between a home equity loan and a HELOC?

5. How do I choose the best home improvement loan for my project?

best home improvement loans