Long Term Cash Loans

When it comes to financial flexibility, long term cash loans can be a game-changer. These loans are designed to provide borrowers with the funds they need over an extended period of time, making it easier to manage their expenses and pay back the loan at a pace that works for them. In this article, we will explore what long term cash loans are, how they work, and why they can be a valuable financial tool for those in need of extra funds.

What does it mean?

Long term cash loans are a type of loan that provides borrowers with a substantial amount of money that is to be paid back over an extended period of time, typically several months to several years. These loans are different from short term loans, which are designed to be paid back in a shorter period of time, such as a few weeks or months. Long term cash loans are often used for larger expenses, such as home renovations, car repairs, or debt consolidation.

How do long term cash loans work?

When you apply for a long term cash loan, you will typically be required to provide information about your income, employment status, and credit history. The lender will use this information to determine how much money you are eligible to borrow and what interest rate you will be charged. Once approved, you will receive the funds in one lump sum, which you can use for any purpose you see fit. You will then be required to make regular monthly payments until the loan is paid off in full.

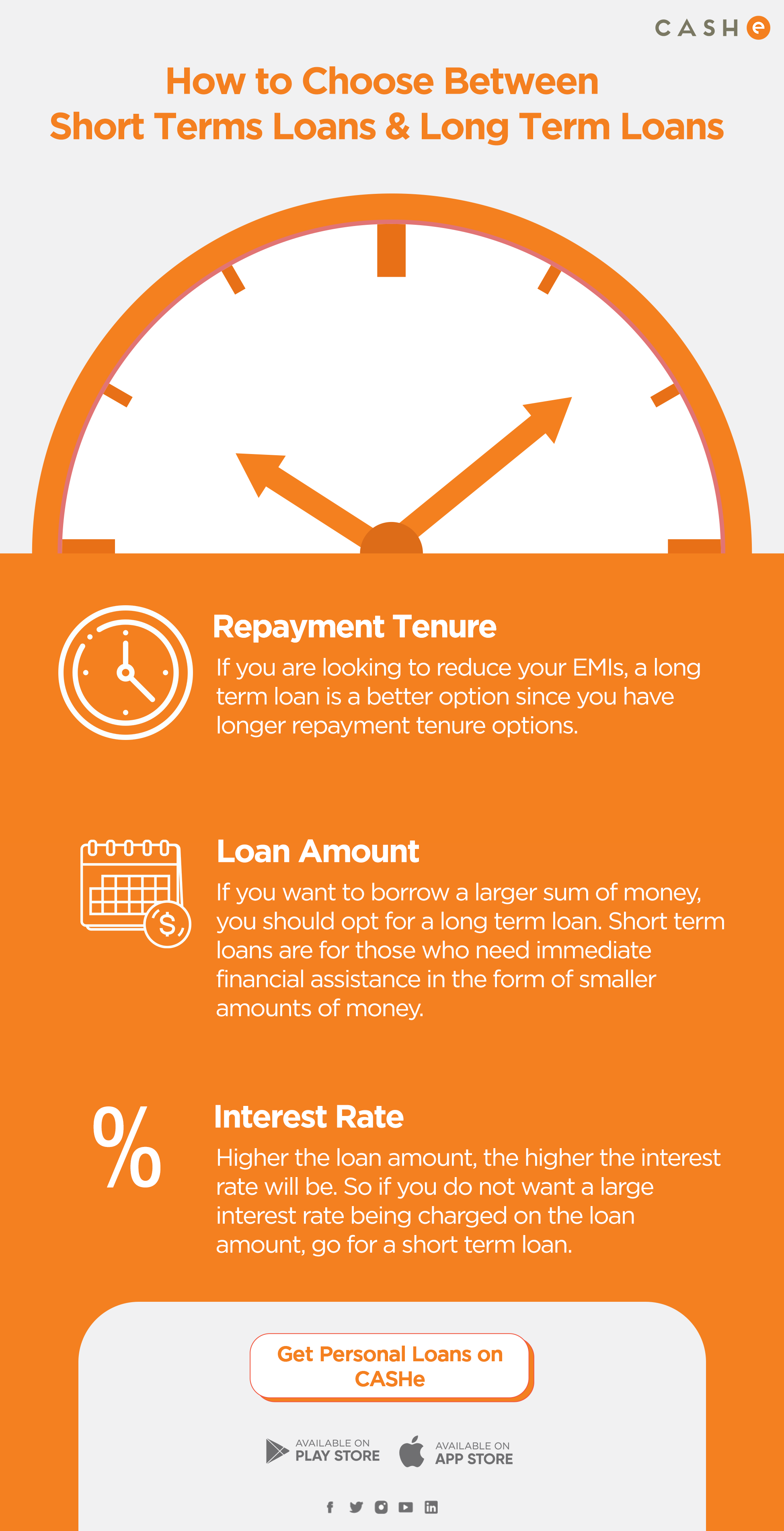

Image Source: cashe.co.in

What is known about long term cash loans?

Long term cash loans are known for their flexibility and convenience. Unlike some other types of loans, such as credit cards or payday loans, long term cash loans offer fixed rates and predictable monthly payments, making it easier to budget and plan for the future. Additionally, long term cash loans are available to borrowers with a wide range of credit scores, making them accessible to those who may not qualify for traditional bank loans.

Solution

If you find yourself in need of extra funds to cover a large expense, a long term cash loan may be the solution you are looking for. These loans can provide you with the money you need to take care of your expenses without having to worry about paying it back all at once. With flexible repayment terms and competitive interest rates, long term cash loans offer a reliable and convenient way to access the funds you need.

Information

Before applying for a long term cash loan, it is important to do your research and compare lenders to find the best option for your needs. Be sure to read the terms and conditions of the loan carefully, including the interest rate, repayment terms, and any fees or penalties that may apply. By being informed and prepared, you can make the most of your long term cash loan and use it to achieve your financial goals.

Conclusion

In conclusion, long term cash loans can be a valuable financial tool for those in need of extra funds to cover large expenses. With flexible repayment terms, competitive interest rates, and accessibility to borrowers with a wide range of credit scores, long term cash loans offer a convenient and reliable way to access the funds you need. By doing your research, comparing lenders, and being informed about the terms of the loan, you can make the most of your long term cash loan and use it to achieve your financial goals.

FAQs

Q: Can I apply for a long term cash loan with bad credit?

A: Yes, many lenders offer long term cash loans to borrowers with less than perfect credit. However, you may be charged a higher interest rate or be required to provide additional documentation to qualify for the loan.

Q: How long does it take to get approved for a long term cash loan?

A: The approval process for a long term cash loan can vary depending on the lender and your individual financial situation. In some cases, you may be approved and receive the funds within a few days, while in other cases it may take longer.

Q: What is the difference between a long term cash loan and a personal loan?

A: Long term cash loans are a type of personal loan that is designed to be paid back over an extended period of time. Personal loans, on the other hand, can have shorter repayment terms and may be used for a wider range of purposes.

Q: Are there any fees associated with long term cash loans?

A: Some lenders may charge fees such as origination fees, late payment fees, or prepayment penalties for long term cash loans. Be sure to read the terms and conditions of the loan carefully to understand any fees that may apply.

Q: Can I use a long term cash loan to consolidate debt?

A: Yes, long term cash loans can be used to consolidate debt from multiple sources into one monthly payment, making it easier to manage and pay off your debts over time.

long term cash loans