Hard Money Lenders for Business Acquisition

What Does It Mean?

Hard money lenders are individuals or companies that provide short-term loans to businesses or individuals in need of quick financing. These loans are secured by the value of the property being purchased, rather than the borrower’s credit history. Business acquisition refers to the process of buying an existing business or acquiring a stake in a company. Hard money lenders for business acquisition provide the necessary funds to complete the purchase, allowing the borrower to take advantage of investment opportunities.

How Does It Work?

When a business owner or investor decides to acquire a business, they may need to secure financing to complete the purchase. Traditional lenders such as banks may have strict lending criteria and a lengthy approval process, making it difficult for some borrowers to obtain the funds they need quickly. Hard money lenders, on the other hand, offer fast approval and funding, making them a popular choice for business acquisition loans. Borrowers can use the loan to purchase the business and then repay the lender within a specified time frame, typically with interest.

What Is Known About Hard Money Lenders for Business Acquisition?

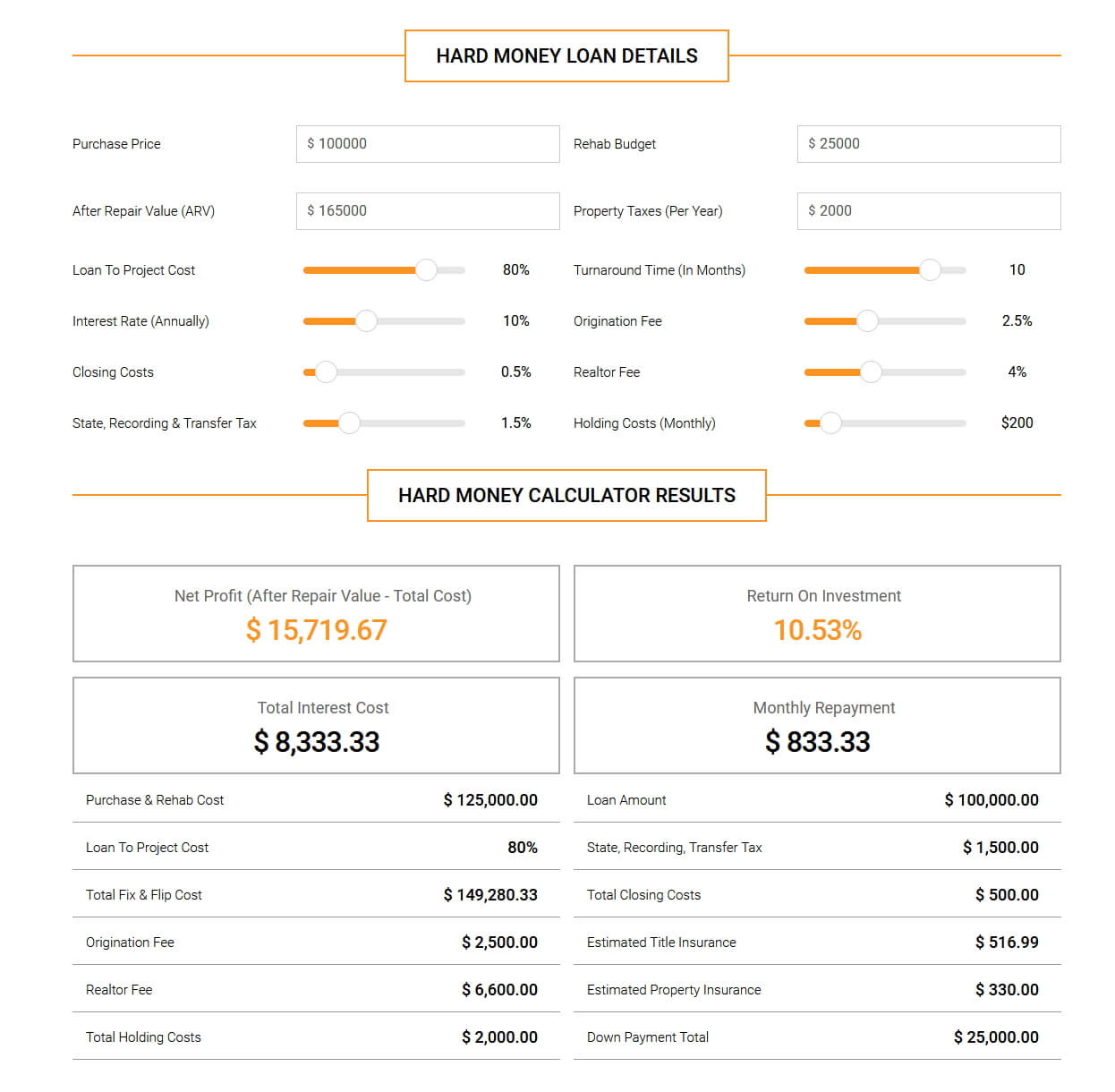

Image Source: newsilver.com

Hard money lenders for business acquisition are known for their quick approval process and flexible lending terms. These lenders are often more willing to work with borrowers who may not qualify for traditional bank loans due to credit issues or other factors. Hard money loans are typically short-term, ranging from a few months to a few years, and carry higher interest rates than traditional loans. However, borrowers can access the funds they need quickly to take advantage of time-sensitive opportunities.

Solution for Business Owners

For business owners looking to acquire a new business or expand their existing operations, hard money lenders can provide a valuable financing solution. By working with a hard money lender, business owners can access the funds they need quickly and without the hassle of a lengthy approval process. This can help them take advantage of investment opportunities and grow their business without waiting for traditional bank financing.

Information on Hard Money Lenders for Business Acquisition

When considering a hard money lender for a business acquisition loan, it is important to research the lender’s reputation and lending terms. Some hard money lenders may specialize in certain types of business acquisitions or industries, while others may have specific requirements for loan approval. Business owners should also compare interest rates, fees, and repayment terms to ensure they are getting the best deal possible. Working with a reputable hard money lender can help business owners secure the financing they need to make their acquisition dreams a reality.

Conclusion

Hard money lenders for business acquisition offer a valuable financing option for business owners and investors looking to purchase a new business or expand their operations. These lenders provide quick approval and funding, allowing borrowers to take advantage of investment opportunities without the hassle of traditional bank loans. By researching and comparing hard money lenders, business owners can find the right financing solution for their specific needs and secure the funds they need to grow their business.

Frequently Asked Questions

1. What are the advantages of using a hard money lender for business acquisition?

Using a hard money lender for business acquisition offers quick approval and funding, flexible lending terms, and the ability to access funds without meeting strict bank criteria.

2. How do I qualify for a business acquisition loan from a hard money lender?

Qualifying for a business acquisition loan from a hard money lender typically requires a strong business plan, collateral, and a clear strategy for repayment.

3. Are hard money loans a good option for all types of business acquisitions?

Hard money loans may not be suitable for all types of business acquisitions, so it is important to research and compare lenders to find the best fit for your specific needs.

4. What are the typical interest rates for hard money loans for business acquisition?

Interest rates for hard money loans for business acquisition can vary depending on the lender, the borrower’s creditworthiness, and the terms of the loan. It is important to compare rates and fees before making a decision.

5. How can I find a reputable hard money lender for my business acquisition needs?

You can find reputable hard money lenders for business acquisition by researching online, asking for referrals from other business owners, and comparing lending terms and rates to find the best fit for your financing needs.

hard money lenders for business acquisition